Like many Australians, you may be missing out on opportunities to boost your super because you haven’t been able to keep up with recent changes to the rules. It can be difficult to know how they may affect your retirement savings plans and, importantly, what you need to do in response.

Now is a good time to review your super with the aim of making the most of the available strategies for building your super and retirement savings.

#1: A helping hand from the Government

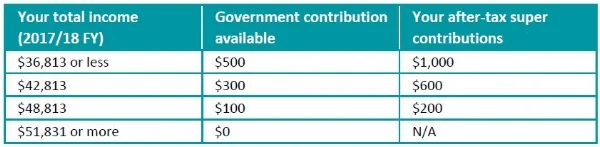

If you work part-time or run a business, earn less than $51,813 per annum and make after-tax (non-concessional) super contributions, you could be eligible for a co-contribution of up to $500 each year from the Government. The Government co-contribution scheme is an incentive to help low and middle income earners grow their super.

As a general rule, for every dollar you contribute, the Government will contribute 50c (up to $500), depending on your income. For example:

There are strict conditions associated with this scheme so it’s important to seek professional advice to determine if it is appropriate for you. Key conditions include:

- 10% of your income must come from employment or carrying on a business;

- Your total income includes assessable income, fringe benefits and reportable employer super contributions;

- Your super balance must be less than $1.6 Million; and

- You must not have exceeded after-tax contribution (non-concessional contributions) cap.

#2: Help your spouse build their super and receive a tax break

If your spouse (married, defacto or same sex partner) earns less than $37,000 total income per year (being assessable income, fringe benefits and reportable employer super contributions), you can contribute up to $3,000 in non-concessional contributions to their super fund and receive a tax offset of $540. You are able to contribute more than $3,000 to your spouse’s super fund; however the tax offset will remain capped at $540. Your spouse must be under 70 years of age, must have less than $1.6 Million in super and must not have exceeded their non-concessional contribution cap.

You can also share your employer super contributions with your spouse. As a general rule, super contributions can only be split in the financial year after the contributions were made. There are rules and conditions associated with contribution splitting so it’s important to seek professional advice.

#3: Make tax deductible super contributions – even if you’re not self-employed

Prior to 1 July 2017, only substantially self-employed people were able to claim a tax deduction for personal super contributions. Now, most people under 65 years of age (and those who meet a work test between 65-74), are able to claim a tax deduction for personal super contributions.

Personal contributions can be used to boost your super balance up to the concessional contributions cap of $25,000 per annum. Making before-tax super contributions may also reduce your assessable income and this could save you tax. It’s important to seek advice from a tax professional to understand tax implications associated with this strategy.

#4: Salary sacrificing for retirement savings

Salary sacrificing can be a strategy to reduce the tax you pay.

Further, a concessional contribution catch-up provision will be introduced in 2019/20 (for super funds with a balance less than $500,000), which will allow you to carry forward any unused portions of concessional contributions for up to five years, helping you to boost your super balance.

Salary sacrifice (concessional) contributions are taxed at 15% (or 30% for those with a total income over $250,000 per annum), which is usually less than personal marginal tax rates. Concessional contributions include your employer’s 9.5% contributions, as well as any salary sacrifice or contributions for which you claim a tax deduction. If you exceed the concessional contributions cap, penalties will apply.

#5 Pay for personal insurances with pre-tax dollars

Holding and paying for insurances (such as Life Insurance and Total and Permanent Disability (TPD) Insurance) through your super fund may mean you can pay for premiums out of your pre-tax dollars or arrange to have your premiums deducted from your account balance. This may improve your cash flow and make insurance premiums more affordable.

However, it is important to note that having an insurance policy in place does not mean you are adequately insured. The true value of any insurance policy is in the detail. Understanding insurance coverage can be confusing so it’s vital to seek professional advice to help you understand the options available and allow a proper assessment of the appropriateness of policies for your individual circumstances.

Finally, it’s important to note that all contributions to super are preserved until you meet a condition of release.

If you would like advice on how to make the most of the strategies available to you for superannuation and retirement planning, I encourage you to contact our office on 07 3720 1299 or email admin@wealthfundamentals.com.au.

Lane Moses Pty Ltd ABN 56 092 186 117 trading as Wealth Fundamentals and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.

The information (including taxation) contained within this document does not consider your personal circumstances and is of a general nature only - unless otherwise stated. Wealth Fundamentals strongly suggests that you should not act on it without first obtaining professional advice specific to your circumstances. This information is based upon our understanding of legislation at the time of writing. Such legislation may be subject to change.

This publication cannot be reproduced in any form without the express written consent of the author.