If you would like to reduce your mortgage interest payments or are considering turning your home into an investment property, using an offset account could save you thousands.

An offset account is a bank account which allows you to ‘offset’ the amount you owe on your mortgage against the savings you have in your bank account. An offset account is like a standard bank account, in that you are able to have your salary paid into the account and access funds within your account for everyday expenses.

How it works

An offset account is linked to your home loan or investment property loan and the amount you have in your offset account is counterbalanced daily against your outstanding loan balance. For example:

Using an offset account with a minimum savings balance of $20,000, for a home loan of $300,000, at 5.5% interest over 25 years, could save you over $52,000 in interest payments and remove 2 years and 4 months from the term of your loan.

If you have an offset account with a minimum savings balance of $20,000, this balance will be used to reduce the balance of the mortgage that incurs interest. In this example, you are only paying interest on $280,000 (not $300,000).The savings balance in your offset account is continually offset against your home loan balance throughout the life of the loan.

Increasing your savings balance to $50,000 could reduce your loan term further to 19 years and 11 months and save you over $110,770 in interest.

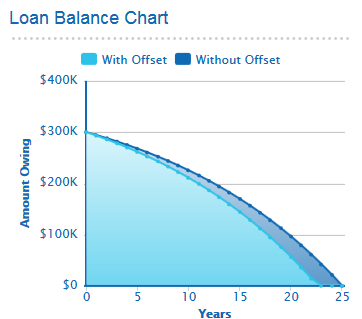

Offset Account Balance $20,000

Loan Amount: $300,000

Interest Rate: 5.5%

Loan Term: 25 Years

Repayment Frequency: Monthly

Offset Account Balance: $20,000

RESULTS

Monthly Repayment: $1,842.26

Interest Saved: $52,165.88

Time Saved: 2 years, 4 months

Revised Time: 22 years, 8 months

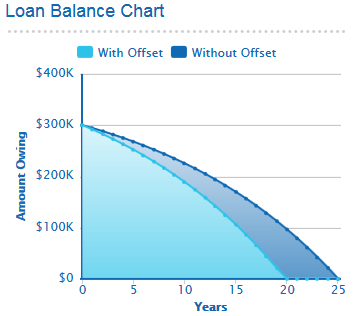

Offset Account Balance $50,000

Loan Amount: $300,000

Interest Rate: 5.5%

Loan Term: 25 Years

Repayment Frequency: Monthly

Offset Account Balance: $50,000

RESULTS

Monthly Repayment: $1,842.26

Interest Saved: $110,773.92

Time Saved: 5 years, 1 month

Revised Time: 19 years, 11 months

The more money you have in your offset account, the less interest you pay which can help you reduce the term of your loan.

Benefits for you

Save thousands on your mortgage

Even having a small balance in an offset account can result in significant savings over the term of your mortgage.

Turn your home into an investment property

There can be tax advantages if you are considering turning your home into an investment property. If you are renting out your home, rental payments can be directed to your offset account. Essentially this will build your offset balance and help reduce your interest payable on any remaining debt. Given that it is an investment property, you will also be able to claim tax deductions for your interest payable.

The fine print

It’s important to do your homework to investigate if an offset account is an appropriate strategy for your personal circumstances. Different institutions will offer different products and may have different interest rates, fees and charges associated with the accounts. Some offset accounts may only offer a partial offset as opposed to 100%, or only offer 100% offset for variable rate loans.

It’s also important to have a strong savings discipline if you are considering an offset account, as all your savings are accessible within the account.

If you would like advice on your financial affairs or would like to discuss your financial future, I invite you to contact our office on 07 3720 1299 or email admin@wealthfundamentals.com.au

Lane Moses Pty Ltd ABN 56 092 186 117 trading as Wealth Fundamentals and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.

The information (including taxation) contained within this document does not consider your personal circumstances and is of a general nature only - unless otherwise stated. Wealth Fundamentals strongly suggests that you should not act on it without first obtaining professional advice specific to your circumstances.

This information is based on our understanding of legislation at the time of writing. Such legislation may be subject to change. This publication cannot be reproduced in any form without the express written consent of the author.