If you are over 65 years of age, there are significant incentives in place to downsize.

A Government initiative, introduced last year, allows you to contribute up to $300,000 to your super from the proceeds of selling your home. There are no restrictions on purchasing a smaller house and you don’t even need to re-enter the property market to benefit from the incentive.

How the incentive works

The incentive allows homeowners aged 65 years or older to make an after-tax contribution to their super of up to $300,000 from the proceeds of the sale of their home. A couple may contribute a total of $600,000, by each contributing $300,000 to their super.

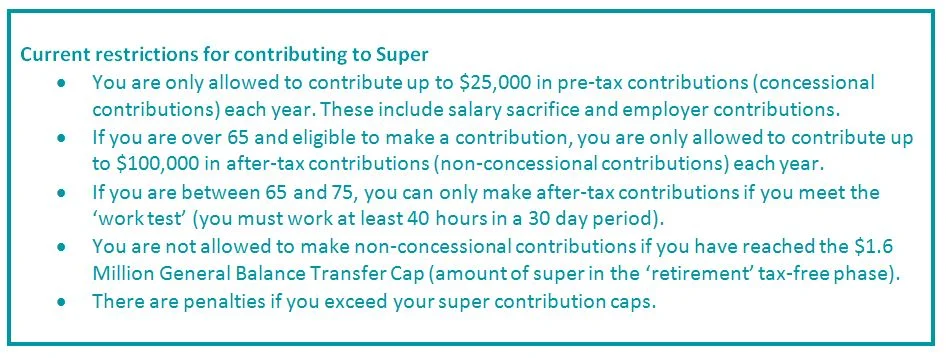

The only way to get funds into super is by making a contribution, and a number of rule changes associated with super over the last few years have made it more difficult to contribute large sums of money into super, as shown below. These “downsizer” contributions can be an effective way for pre-retirees or retirees to build their super balances without the usual restrictions associated with super contributions.

Superannuation is considered one of the most tax-effective investments for creating wealth, and it offers retirees a tax-free income stream in retirement. Often, people close to retirement may have little cash flow as their wealth is tied up in assets accumulated during their lifetime. The downsizing incentive provides an option for them to build superannuation savings for retirement.

Benefits of the downsizing scheme

#1 You don’t need to be working to make a contribution

If you are between 65 and 74, you can only make non-concessional contributions if you pass the work test, that is working at least 40 hours in a 30-day period. Downsizing contributions are not treated in the same manner as non-concessional contributions, which means you can contribute your ‘downsizer’ to your super even if you are not working.

#2 You can contribute up to $300,000 or $600,000 as a couple to your super

The downsizer incentive allows a contribution of up to $300,000 to your super from the proceeds of the sale of your house. Each spouse can contribute up to $300,000 to their own fund, however the total contribution must not be greater than the total proceeds from the sale of your house. For example, if your home sells for $450,000, you are only able to contribute $450,000 as a couple. The proceeds can be split between your two funds however you choose, but $300,000 is the most that can be contributed to a single fund.

#3 Downsizer contributions are not included in your after-tax contribution cap

Downsizer contributions are not included in your non-concessional contributions cap ($100,000 per annum) and you can still make a downsizer contribution even if you have reached your $1.6 Million Transfer Balance Cap.

#4 There is no upper age limit for making a downsizer contribution

Unlike other voluntary contributions to super, there is no upper age limit for making downsizer contributions. (Usually a fund member must be less than 75 years of age and subject to the work test to make a voluntary contribution to super.)

#5 You don’t actually need to downsize or re-enter the property market

If you take advantage of the downsizer incentive to grow your super, there is no requirement to literally downsize your home or to re-enter the property market.

Other considerations

There are strict rules and eligibility for the incentive and it’s also important to consider how it may affect your overall financial goals and retirement plans.

Eligibility

You must be 65 years of age or older.

The incentive only applies to a property that is considered your principal place of residence and has been owned by you or your spouse for more than ten years. It cannot be used for properties earning assessable income such as investment properties.

The property must be exempt or partially exempt from Capital Gains Tax (under the main residence exemption) or if the home was acquired before 20 September 1985.

Caravans, houseboats or mobile homes are not eligible.

Contributions can only be made from the sale of property from 1 July 2018 and the downsizing contribution must be made to your super fund within 90 days using a Downsizer Contribution Form.

You can only access the downsizing scheme once.

Selling your family home may affect your available pension payments (full age pension or part pension) as superannuation is assessed within the Age Pension Assets Test, while the family home is exempt from the assets test.

While considering whether or not the downsizing initiative is appropriate for you, it’s also important to consider the costs associated with buying and selling. We recommended you seek professional financial advice to understand how the downsizing scheme may affect your overall long term financial goals and needs.

If you would like advice on making the most of your super in the lead up to retirement or would like to discuss planning for your retirement, I invite you to contact our office on 07 3720 1299 or email admin@wealthfundamentals.com.au

Lane Moses Pty Ltd ABN 56 092 186 117 trading as Wealth Fundamentals and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This is general advice only and does not take into account your objectives, financial situation or needs, so you should consider whether the advice is relevant to your personal circumstances. You should also read the relevant Product Disclosure Statements (PDS) before making any financial decisions.