Don’t wait for the benefit of hindsight when it comes to making the most of your finances.

Many people hold off seeking financial advice until they are in their pre-retirement years, but the fact is you can gain the most financially by seeking professional advice much earlier.

Seeking financial advice is about gaining a true understanding of your financial options and potential outcomes, so you can make more informed decisions to achieve your financial goals.

Learn how to make the most of your hard-earned money from the benefit of our collective decades of experience and professional hindsight.

What you do now really does matter

Financial freedom starts from small, simple steps. By having a plan in place and starting early, you can implement small financial steps which can make a big difference such as:

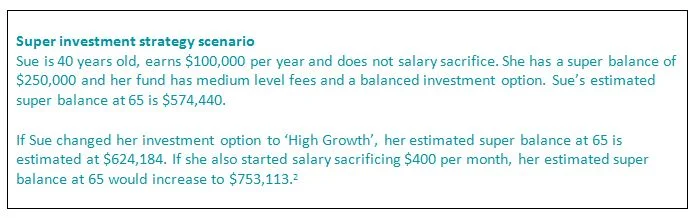

Boost your super: Simple strategies such as salary sacrificing can make a difference of hundreds of thousands of dollars at retirement, as shown in the scenario below. Salary sacrifice or pre-tax contributions are taxed at 15% which is usually lower than your marginal tax rate, and means you will benefit from tax advantages.

Super choices: Making a simple change to your super investment strategy beyond the ‘default’ investment strategy (usually a ‘Balanced’ option) can also make a significant difference to your savings, as shown below.

Don’t wait until it’s too late: Changes to super legislation over the last few years have made it more difficult to contribute large sums of money into super, making it more important to implement a contributions strategy early.

Other strategies: Depending on individual financial goals and current circumstances, other strategies may be more appropriate, such as debt management to reduce your debt liability or starting an investment portfolio outside of super if you have financial priorities for the shorter term.

Life happens – be prepared

It can be easy to think it won’t happen to me, but statistics tell us a different story, so you need to have a plan to safeguard your financial position should the unexpected occur.

Personal insurances: A survey revealed that 29% of Australians would only have savings to support themselves for one month or less if they were unable to work due to illness or injury, with 65% only having savings to support themselves for less than six months [3]. Further, it is estimated that men have a 40% risk and women a 25% risk of suffering a traumatic illness between the ages of 30 and 64. [4]

Personal insurances (including Income Protection Insurance, Total Permanent and Disability Insurance and Life Insurance) can be complex when it comes to understanding policy inclusions and implementing appropriate cover for your circumstances, so it’s recommended you seek professional advice to ensure you have the cover you think you do.

Consider your legacy: Your circumstances in life can change quickly, so it’s important to have a plan to protect the wealth you have accumulated and consider your legacy in terms of avoiding conflict or litigation after your passing or inadvertently disadvantaging the ones you love. Estate Planning is complex and will need to involve all your key financial stakeholders (such as your financial adviser, accountant and solicitor) to understand implications from a financial, legal and tax perspective.

Aged Care Planning: While you may never require aged care facilities, it’s vital to know what’s involved as the need to move may be urgent. It’s vital to seek professional advice as there can be enormous financial consequences associated with decisions about aged care. These decisions may include whether to move into aged care as a couple or as an individual, and whether to sell your family home to pay for aged care costs.

One-size does not fit all – everyone’s financial priorities are different

Don’t fall into the trap of assuming that one size fits all when it comes to financial planning. Your financial goals and priorities are unique and will change over time, so your financial strategies need to be reviewed and updated too.

Changes to your circumstances such as a pay rise may mean you need to address your super strategy to avoid exceeding contributions caps, or the divorce or remarriage of you or a close relative may mean you need to review your Estate Plan to protect your assets or prevent unwanted tax complications.

A good financial plan needs to consider every aspect of your financial life, with all strategies working together to achieve your goals. It’s important to understand your options and consider what different scenarios may mean for your financial health.

Don’t miss out on the advice you need. If you would like to know more about financial strategies to help create financial independence, I encourage you to contact us now on 07 3720 1299 or email admin@wealthfundamentals.com.au

Lane Moses Pty Ltd ABN 56 092 186 117 trading as Wealth Fundamentals and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This is general advice only and does not take into account your objectives, financial situation or needs, so you should consider whether the advice is relevant to your personal circumstances. You should also read the relevant Product Disclosure Statements (PDS) before making any financial decisions.

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/superannuation-calculator See assumptions and disclaimers.

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/superannuation-calculator See assumptions and disclaimers.

Gen Re Australia 2009.Australian Critical Illness Survey 2008: a study of claims experience 2001 to 2005